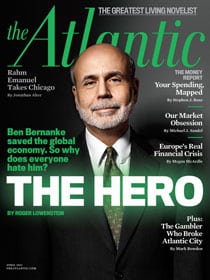

The April issue of The Atlantic has a worshipful piece on Federal Reserve Chairman Ben Bernanke, featuring him on the cover with the moniker, “THE HERO”. “Ben Bernanke saved the economy”, hails the author, Roger Lowenstein, who also characterizes the Fed as a temple of wisdom from whence is derived a stable and healthy economy, thanks to the workings of its enlightened monetary policy, without which our economy would descend into chaos and despair.

The piece begins by describing the Fed as “a bulwark to the banking system and an antidote to its frequent runs and panics”. Lowenstein goes into the history of central banking in the U.S., pointing out that the Fed is the U.S.’s “third attempt at a central bank”. The first one lasted from 1791 until 1811, when Congress allowed its charter to expire. But the Congress “realized its error” during the War of 1812 because “in the absence of a central bank, inflation had run rampant”. So the Second Bank of the United States was established and it “astutely managed” its supply of notes “so as to keep the economy humming. Alas, President Andrew Jackson, a fierce opponent of both paper money and national banks, campaigned in 1832 against renewal of the charter,” and after he won the election, the bank was “destroyed” and the “economy promptly plunged into a severe depression.”

The history Lowenstein offers here could perhaps best be described as the establishment-approved version. Murray N. Rothbard offers an antidote to it in his book A History of Money and Banking in the United States, in which he explains how the federal government, to finance its debt during the War of 1812, “encouraged the formation of new and recklessly inflationary banks … which printed huge quantities of new notes to purchase government bonds.” Unincorporated banks also sprang up, “which were illegal in most states but were allowed to function under war conditions.”

Eventually, unsound banks began to face insolvency, but rather than allowing bankruptcy and liquidation, the government stepped in and, “in one of the most flagrant violations of property rights in American history”, relieved the banks of their contractual obligation to redeem their notes and deposits in gold or silver. In fact, writes Rothbard, “a major inflationary impetus during the War of 1812 came during the year 1815 after specie payments had been suspended” (emphasis added). He continues:

Historians dedicated to the notion that central banks restrain state or private bank inflation have placed the blame for the multiplicity of banks and bank credit inflation during the War of 1812 on the absence of a central bank. But … the federal government, not the state banks themselves, is largely to blame for encouraging new, inflated banks to monetize the war debt. Then, in particular, it allowed them to suspend specie payment in August 1814, and to continue that suspension for two years after the war was over, until February 1817. Thus, for two and a half years banks were permitted to operate and expand while issuing what was tantamount to fiat paper and bank deposits.

Besides monetary inflation, the cutoff of trade during the war also pushed prices upwards. And the government’s act of permitting the banks to suspend redemption in specie set a dangerous precedent that was to be followed in numerous banking crises throughout U.S. history. Rothbard comments:

It thus became clear to the banks that in a general crisis they would not be required to meet the ordinary obligations of contract law or of respect for property rights, so their inflationary expansion was permanently encouraged by this massive failure of government to fulfill its obligation to enforce contracts and defend the rights of property.

In the aftermath of the war, rather than compelling banks that had lent irresponsibly to honor their legal obligations or to liquidate, the Second Bank of the United States was established “to support the state banks in their inflationary course”. The banks agreed to resume specie payments only after the new central bank issued $6 million worth of credit to them, a “massive inflation” at the time. Rothbard quotes Senator William H. Wells arguing against the bank bill by saying that it was

ostensibly for the purpose of correcting the diseased state of our paper currency by restraining and curtailing the overissue of bank paper, and yet it came prepared to inflict upon us the same evil, being itself nothing more than simply a paper-making machine.

“From its inception,” Rothbard writes, “the Second Bank launched a spectacular inflation of money and credit” and, “in a scant year and a half of operation, the Second Bank of the United States had added a net of $19.2 million to the nation’s money supply, a “huge expansion of money and credit” that “impelled a full-scale inflationary boom throughout the country”, which led to the “first nationwide ‘boom-bust’ cycle” in the United States.

So, to review, we are supposed to think that the country needed a central bank to prevent “rampant inflation”, and once Jackson killed this central bank, the brakes on inflation were released and disaster ensued when the “economy promptly plunged into a severe depression”, a reference to the Panic of 1837.

What happened was that the bank’s president, Nicholas Biddle, in 1831 filed for early renewal of its charter, which was set to expire in 1836. Jackson vetoed it, and Congress failed to pass it over his veto. In 1833, Jackson removed public Treasury deposits from the Second Bank of the United States and put them in state banks. This marked the effective end of its role as a central bank of the United States, although its charter didn’t expire until 1836, after which it operated as a regular bank until its failure several years later.

Rothbard comments that

Orthodox historians have long maintained that by his reckless act of destroying the Bank of the United States and shifting government funds to the numerous pet banks, Andrew Jackson freed the state banks from the restraints imposed on them by a central bank. Thus, the banks were supposedly allowed to pyramid notes and deposits rashly on top of existing specie and precipitate a wild inflation that was later succeeded by two bank panics and a disastrous deflation.

But the “conventional” view is belied by the fact “that the driving force for monetary expansion was the Bank of the United States, which acted as an inflationary rather than a restraining force upon the state banks.”

As for the inflation that occurred from 1833-37, Rothbard writes that it was the consequence of an inflow of gold and silver coin into the country, such that “the total specie in the country rose swiftly from $31 million to $73 million”. The banks then pyramided on top of their increased reserves, inflating through fractional reserve lending. One could thus argue that the government during the Jackson administration did not go far enough in merely ending the inflationary role of the central bank, but should have also enforced a 100% reserve requirement, which would forbid banks from loaning notes representing gold or silver that they didn’t have. That is to say, it could be argued that the government should have also ended the practice of legalized counterfeiting.

This brings us back to the description of the Federal Reserve as “an antidote” to the banking system’s “frequent runs and panics”. The Fed’s record of utter failure as far as being an “antidote” to the business cycle speaks for itself, from the Great Depression to today’s “Great Recession”. But what about bank runs? We are supposed to think this was some kind of evil for which we require a central bank to defeat by acting as the lender of last resort. But what was wrong with bank runs? This comes back again to the purpose of the Federal Reserve, cognitive dissonance notwithstanding, being not to check, but to enable the coordinated inflation of banks. Bank runs, if they were allowed to occur, would keep banks more honest by requiring them to keep more in reserves to be able to honor their customers’ demands for the return of their own property. Bank runs weren’t some kind of poison requiring the antidote of a central bank; on the contrary, they were an antidote to the poison of legalized counterfeiting.

Of course, banks didn’t like bank runs, so from the point of view of the counterfeiters, it certainly must have been an “antidote” for the government to step in to support their inflationary habits by permitting them to suspend redemption (i.e., violate their contractual obligations) and by establishing a central bank that could act as a “lender of last resort” to bail them out if they got into trouble.

After providing a history lesson friendly to the moneyed interests of the nation, Lowenstein returns to the present day. He announces that the economy has “begun to show signs that the recovery is gaining steam”, thanks to our “hero”, Ben Bernanke, who has “worked overtime to furnish an ‘elastic currency’—that is, to keep enough money in circulation for the economy to function”. Bernanke has accomplished this “by tripling the size of the Fed’s balance sheet—to an eye-popping $2.9 trillion”. Bernanke had also “bailed out a handful of large banks” and “lowered short-term interest rates to nearly zero”, all of which “was a success”. “[T]he financial crisis”, Lowenstein declares, “is over.” Having thus heroically ended the financial crisis, Bernanke has continued to maintain “short-term interest rates at close to zero” and purchased “in vast quantities, long-term Treasury bonds and mortgage-backed securities.”

All of this is to say that our “hero” saved the economy by ensuring a total lack of accountability for banks that engaged in unsound practices, rewarding them for their excessive risk-taking and rescuing them from the fate of bankruptcy and liquidation they would have suffered in a free market system, and by printing money (or, rather, punching some keys to add digits on a computer). There is an alternative hypothesis, which is that such actions haven’t saved the economy from a recession, but merely prolonged the pain and postponed the inevitable. This counter-argument is supported by the more recent history showing that the Federal Reserve responded to the bursting of the dot-com bubble by inflating to prevent a recession, which policy had the consequence of creating the housing bubble. Our “hero”, then, is “saving” the economy by continuing to do the same things that caused the financial crisis in the first place.

Lowenstein seems not to countenance this alternative hypothesis, but returns to history for guidance, comparing the present situation to the Great Depression. Following the collapse of the (Fed-created) housing bubble, Bernanke was faced with “the negative territory known as”—(cue the music)—“deflation.” Oh, the horror! “One reason the Great Depression lasted so long is that prices kept falling, year after year.” According to famed economist Milton Friedman, “the Fed’s failure in the 1930s was a matter of not printing enough money.” Bernanke, however, believes that “it wasn’t the quantity of money”, per se, but that “the banks stopped lending”. The problem during the Great Depression, Lowenstein asserts matter-of-factly, “was deflation: goods were worth less each year—or, alternatively, dollars were worth more”. (Imagine the horror of having increased buying power!) As a result of falling prices, “no one would spend, because lower prices are forever just around the corner, and no one would borrow, because they would have to repay their debts with more valuable currency.” The lack of spending led to production and employment “spiraling downward” in what British economist John Maynard Keynes called a “liquidity trap.”

The underlying assumption here is that consumer spending is what drives economic growth. But where does the money to spend come from? Can simply printing additional money to encourage people to borrow and spend more create real wealth? It’s a bit like asking whether money grows on trees. True economic growth cannot come from simply inflating the money supply, but must come from savings, production, and investment of capital.

Printing money to lower interest rates serves only to distort the economy, sending wrong signals to investors. In a free market economy, when the available pool of capital is great because savings rates are high, that is reflected in low rates of interest. Banks with plentiful reserves want to attract borrowers, just as when reserves are low, they will raise interest rates to attract depositors. When savings are high, entrepreneurs can borrow at low interest to invest in capital goods to be able to increase production for future consumption, once people start spending again. Saving, after all, is simply the act of deferring spending to the future (a behavior often denounced as “hoarding”).

But when interest rates are artificially low because the central bank has engaged in a policy of monetary inflation, it creates the illusion that there is plenty of capital available to invest in longer-term projects. Price inflation may not manifest itself as a uniform rise in prices of consumer goods, but as the new money enters the economy and the excess credit is directed into particular sectors (such as capital goods, tech stocks, housing, etc.), prices in those sectors begin to rise. Everyone hails how wonderful the boom is, but it is an artificial and unsustainable boom, and this bubble eventually must burst. Reality sinks in as the malinvestment reveals itself.

As for unemployment, the reason it remained so high during the Great Depression is not because prices were falling, but because wages, which are also a price, weren’t permitted to also fall at the same time. Real wages actually increased, and the consequence of the price-fixing of wages was massive unemployment. Ironically, this phenomenon is indirectly acknowledged by Lowenstein further into the article (which we’ll return to).

As for falling prices, why should this be something we are to fear? Isn’t it a good thing that one can buy a computer today that is a hundred or a thousand times better machine than was available ten years ago, and yet the cost is actually less? In what way is paying less for more a bad thing? All else being equal, as advancements are made in the means of production, it is a natural consequence that prices will fall over time. In what way is it not desirable to have more purchasing power for each dollar you spend, rather than less?

This returns us to the basic assumption that spending drives the economy. People must be incentivized to borrow, borrow, borrow, and spend, spend, spend, according to this logic. This is the same logic upon which was premised the Fed’s policy of artificially low interest rates following the collapse of the dot-com bubble. It was this inflationary policy that created the housing bubble.

As Lowenstein points out, Bernanke “did not anticipate the looming crash in home prices”. His “training” had “failed him.” But rather than examining the Fed’s role (under Bernanke’s predecessor, Alan Greenspan) in creating the housing bubble, Lowenstein offers that Bernanke’s fault was that “he didn’t scrutinize the banks closely enough” and “overlooked the fact that dicey mortgage-backed securities made up a sizable portion of the assets of the biggest banks.”

After having observed that Bernanke’s education had “failed him” and that Bernanke had been completely blind to the housing bubble, Lowenstein nevertheless offers the remarkable comment that “No one was better suited to the job” of rescuing the economy.

He returns to the discussion of unemployment with the acknowledgment that “Printing money, of course, does not create jobs”. He points out that businesses seeking to maintain their profit margin will tend to lay some people off rather than cut wages. It’s interesting, therefore, that he doesn’t allow that the problem of unemployment during the Great Depression was not that prices were falling, but that wages weren’t. But what he writes next is remarkable for its candidness. Printing money can be good for the economy, he writes, because “Inflation is a less visible way of reducing pay. Workers think they are making the same amount, but since the dollars are worth less, employers can better afford to pay them.” That is to say, inflation is good because it defrauds the working class and stealthily robs them of their purchasing power.

“The second way in which inflation could help the economy”, Lowenstein continues, “is that it makes borrowing and spending more attractive (debtors can repay their loans in cheaper dollars).” That is to say, inflation allows contracts to be effectively violated without any laws protecting property rights having been broken. Perhaps few people care that “Banks and bondholders get cheated” by this, but what about widows and pensioners? Should we care whether they get cheated? Lowenstein continues, pointing out that, “Similarly, people with fixed savings, such as retirees, get punished for their thrift.” But this consideration doesn’t sway him from his view that Bernanke is a “hero” for presiding over the most dramatically monetary inflation in U.S. history.

One of the Fed’s weapons, the article continues, has been so-called “quantitative easing”, or “QE”, Fedspeak for printing money through purchases of long-term securities, which artificially lowers long-term interest rates. The massive increase in the base money supply, however, has not translated into massive price inflation because the banks are sitting on excess reserves. If the banks were to actually loan out their excess reserves, Lowenstein writes, “the supply of currency would nearly triple overnight, and the price of a burger would, you can bet, do the same.”

The reason banks are sitting on excess reserves is “partly because loan demand is weak”. (This would seem to call into question the previous assertion that the problem stems from not having “enough money in circulation for the economy to function”.) The other reason the banks are sitting on excess reserves is because the Fed is paying them to. In 2008, Bernanke “asked for and received expedited authority from Congress to pay interest to banks on their reserves.” This, it is hoped, “will give him time to unwind the balance sheet gradually”, but “No one knows whether this gamble will work.”

It is a feature of centralized banking that power is so greatly concentrated into so few hands, where a single individual may make decisions that affect the whole economy and “gamble” with the lives and fates of others. And yet it is this same establishment, the Federal Reserve, a government-legislated private monopoly over the supply of money and credit, whose altar we are supposed to bow down to.

The article ends with a few remarks about how Bernanke “sticks to his notion of what inflation should be”, “trusting that his judgment will tell him when to add more liquidity, when to subtract.” But we are not supposed to fear or distrust all of this power in the hands of a single man. Rather, we are supposed to worship this individual, elevated to the status of a god by the state, claiming to know better than the free market, better than the law of supply and demand; a god who, endowed with this mystical omniscience, we must entrust to guide us through the darkness and lead us into the light. We are supposed to regard this man as a “hero” who “saved the economy”.

Never mind that all of this man’s powers of insight, all of the vast resources available to him, all of his learned enlightenment told him that there was no housing bubble right up until it burst. Clearly, we are not meant to dwell on such minor details. To “a greater extent than he is credited with now,” Lowenstein concludes, “history may marvel that Bernanke has been a success.”

You just might not want to bet on it.

I loved your article, please also visit mine.