The feds have shut down the digital currency system Liberty Reserve. Mike Adams at Natural News offers these spot-on comments:

If there’s one thing monopolists hate, it’s competition. That’s probably why the U.S. government shut down Liberty Reserve yesterday, charging seven men with laundering $6 billion for over one million clients. Calling Liberty Reserve a “bank of choice for criminals,” the feds won’t be satisfied until they destroy every currency that competes with the U.S. dollar.

That’s because the Federal Reserve is actually the largest money laundering operation of all. It routinely creates trillions of dollars in counterfeit currency for it’s favorite mob banksters like Goldman Sachs and JP Morgan. Disguised with labels like “banker bailouts” or “economic stimulus programs,” these handouts of fiat currency debase all the other dollars held by everyone else. It’s the greatest financial swindle in history, making Bernie Madoff look like an amateur.

One of the problems with Liberty Reserve, as Wired explains, was that it offered individuals a means to transfer currency anonymously. Big Brother doesn’t like that very much.

The other main problem is that, as the indictment filed in the U.S. District Court for the Southern District of New York stated:

Liberty Reserve has emerged as one of the principal means by which cyber-criminals around the world distribute, store and launder the proceeds of their illegal activity.

Shock and horror.

Reuters explains further:

Liberty Reserve, with around 12 million transactions per year, laundered over $6 billion in criminal proceeds since it began operating in 2006, the indictment said.

Gasp.

$6 billion. What a staggering sum of illicit funds.

As I said, Mike’s comments are spot on. The U.S. government will not tolerate any challenge to its legalized counterfeiting operation over at the Federal Reserve. But what about this money laundering? Surely the feds are right to act to put an end to such activity, right?

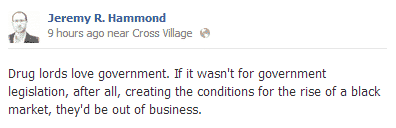

Well, no. For one, how much of this $6 billion alleged to have been laundered through Liberty Reserve was in profits from the drug trade? I just so happened to have made the following relevant comment on Facebook earlier today:

Apart from the point I’m making about the stupidity of prohibition, this is also just another case of pirates and emperors. I refer to the story told by St. Augustine in City of God about how Alexander the Great demands of a captured pirate “how dare he molest the sea”, to which the pirate in turn demands to know “How dare you molest the whole world. Because I do it with a little ship only, I am called a thief; you, doing it with a great navy, are called an emperor.”

What I mean is that of the estimated $1 trillion in illicit funds moving through banks worldwide each year, half is laundered through U.S. banks, according to a Senate staff report. “The failure of U.S. banks to take adequate steps to prevent money laundering through their correspondent bank accounts is not a new or isolated problem,” a Senate Permanent Subcommittee on Investigations report has noted. “It is longstanding, widespread and ongoing.”

Furthermore, as I commented in “The Afghan Drug Trade and the Elephant in the Room“:

According to United Nations Office on Drugs and Crime (UNODC) Executive Director Antonio Maria Costa, drug money was used to help prop up the U.S. economy following the 2008 financial crisis. “In many instances, drug money is currently the only liquid investment capital,” Costa has said. “In the second half of 2008, liquidity was the banking system’s main problem and hence liquid capital became an important factor.” The UNODC found evidence that “interbank loans were funded by money that originated from drug trade and other illegal activities,” Costa said, and there were “signs that some banks were rescued in that way.”

In other words, big money interests and power players within the United States have a financial interest in the preservation of the global drug trade, and U.S. policies and foreign interventions have often historically been aligned with that goal – including in present day Afghanistan.

You begin to see what I mean about Liberty Reserve and its $6 billion figure being the pirate to the U.S. banking system’s $500 billion empire, in addition to the fact that the Federal Reserve is a legalized counterfeiting operation. The federal government must protect its legislated monopoly over the supply of currency and credit.