During Janet Yellen’s Senate confirmation hearing for the job of Chairwoman of the Federal Reserve, she “made clear that she was committed to continuing the Fed’s stimulus campaign”, as the New York Times reports, using a euphemism for printing money out of thin air. “She generally cast herself as committed to continuing the policies of the current Fed chairman, Ben S. Bernanke. “

The Times notes that

Members of both parties questioned whether the Fed’s policies had mostly benefited the wealthy, while doing little to improve life for most Americans… She acknowledged that investors benefited from low interest rates, in part because they helped lift the stock market, but she said that people buying homes and cars also were direct beneficiaries. And she emphasized the indirect benefits of the Fed’s campaign: “The ripple effects go through the economy and bring benefits to, I would say, all Americans.”

But the “ripple effect” of madly inflating the money supply is that as the newly printed dollars are spent into the economy, prices rise. Hence the dot-com and housing bubbles, from which Americans emphatically did not benefit.

But there’s little indication in the Times article that either Yellen or the present Senators have any comprehension about how the Fed’s monetary inflation caused the financial mess the U.S. is in — and how more of the same policy that caused the mess cannot possibly therefore also be the cure. Elizabeth Warren, for example, illustrated her cluelessness:

Some of the strongest questions came from Senator Elizabeth Warren, Democrat of Massachusetts, who criticized the Fed for its regulatory failings before the crisis and expressed concern that it still was not trying hard enough.

“The truth is if the regulators had done their jobs and reined in the banks we wouldn’t need to be talking about” stimulus, Ms. Warren said.

The problem with the Fed wasn’t that it failed to regulate the banking sector, but that it inflated a housing bubble by inflating the money supply to artificially lower interest rates — the exact same policy Yellen has voiced her commitment to continuing, only on a vastly greater scale.

Not everyone at the Fed, though, is completely clueless:

Some Fed officials are concerned that the asset purchases are undermining financial stability by leading to excesses in certain markets. Ms. Yellen said the Fed was paying close attention to that possibility, but “at this stage I do not see risks to financial stability.”

Well, that’s comforting, coming from someone who was saying the same thing about the Fed’s inflationary policy before the housing bubble that precipitated a global financial crisis burst.

Going back to that point about monetary inflation benefiting the rich while hurting the poor, in another piece the Times reports:

When Janet L. Yellen speaks, Wall Street listens — and investors liked what they heard on Thursday.

The stock market reversed an early loss and moved steadily higher in the morning as Ms. Yellen, President Obama’s nominee to head the Federal Reserve, testified at her Capitol Hill confirmation hearing. Monitoring her poised performance from desks around the world, traders concluded that she would stick with policies that have sent shares soaring.

…Ms. Yellen also said that she did not believe that the trillions in stimulus money the Fed has injected into the financial system since the near collapse of the global economy had created a bubble, another very good sign of her supportive views as far as Wall Street is concerned.

“Stock prices have risen pretty robustly,” she said, but at current valuations, “you would not see stock prices in territory that suggests bubblelike conditions.”

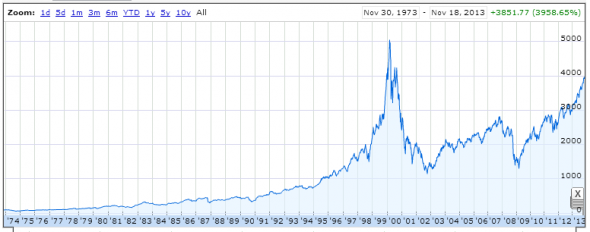

No? Let’s see…

You don’t see anything “bubblelike” there following the dot-com and housing bubbles, do you? No, of course you don’t. Nothing to see here. These aren’t the droids … er, bubbles you’re looking for. Move along.

Then the Times adds this little tidbit:

When Ben S. Bernanke, the departing chairman of the Fed, hinted last spring that $85 billion in monthly purchases of Treasury securities and mortgage-backed bonds might soon be scaled back, stocks promptly plunged…. Ms. Yellen essentially is saying the Fed will not take its foot off the gas until it believes the economy can race ahead on its own.

In other words, the Fed will take its foot off the gas never. Because as soon as it does, the economy is going to collapse, because the “recovery”, such as seen in these stock market gains, is founded on printing money out of thin air rather than representing sustainable growth based on real capital.